By: Drew Edmundson

When does a little bookkeeping cross the line and become a compilation? Have you ever posted a journal entry or made a change directly in a client’s accounting software? With the advent of cloud software and remote access, it is easier than ever to make the adjustment yourself. Is a compilation report required if you make or change entries yourself?

The key is in SSARS 19 (PDF). A compilation report is required when you “submit” a financial statement to a client or others. Unfortunately, the standard does not clearly define “submit.” PPC’s Guide to Compilation and Review Engagements expresses the view that as long as the CPA does not print a financial statement—either on paper or to an electronic file (e.g. PDF)—then a compilation report is not required. So, what is the difference between the CPA entering all the information into the accounting software and then printing it, or even allowing the client to print it.

SSARS Preparation of Financial Statements Exposure Draft (PDF), issued October 23, 2013, tries to solve this conundrum. Preparation is a new level of service below a compilation. While a compilation is an attest engagement, preparation is a nonattest engagement. The ED also provides some examples of when bookkeeping does not rise to the level of preparation:

- Assisting in the preparation of financial statements (still no guidance on when assisting becomes compiling)

- Maintaining depreciation schedules and preparing bank reconciliations

- Certain adjustments such as deferred taxes and depreciation

- Drafting footnotes

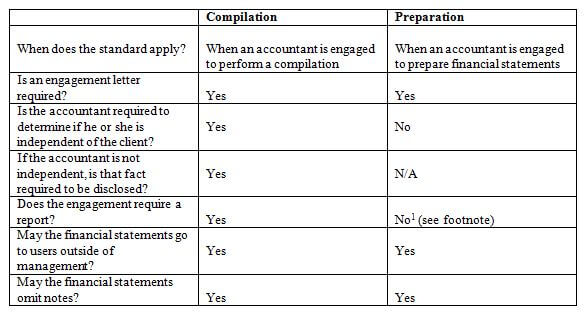

The ED has a nice chart, on page 6 of the PDF, highlighting the major differences:

1 “When an accountant is engaged to prepare financial statements, the accountant is required to include an adequate statement on each page of the financial statements indicating that no CPA provided any assurance on the financial statements. If the accountant is unable to include an adequate statement on each page of the financial statements, the accountant is required to issue a disclaimer on the financial statements.”

Andrew “Drew” Edmundson, CPA, MBA is the managing partner of Edmundson & Company, CPAs in Cary. The firm provides accounting, tax and consulting services. Drew, his wife and their two sons live in Holly Springs and enjoy time at Emerald Isle Beach. Drew can be reached at [email protected].