Effective June 28, the IRS will end its faxing service for individual and business tax transcripts and, effective July 1, the IRS will end its third-party mailing options from the Form 4506 series. The IRS announced both changes last year, but the dates are now confirmed.

The IRS will be issuing a news release and updating IRS.gov pages shortly. The IRS also plans a webinar for tax professionals on June 19, 2 p.m. to review alternatives to faxing and mailing. You can register for the webinar here

Since the IRS last year announced numerous safeguards to protect taxpayer transcripts, the agency has worked with professional associations to assure that you still have access to the information you need for tax preparation.

These alternatives require you to register and have an e-Services account that is protected by two-factor authentication. Tax professionals also have several options to obtain tax transcripts necessary for tax preparation or representation as follows:

- Use e-Services’ Transcript Delivery System online to obtain individual transcripts and business transcripts, or

- Obtain an individual transcript or a business transcript by calling the IRS, if an authorization is not already on file, fax one to the IRS assistor and the IRS assistor will place the transcript in the tax practitioner’s e-Services secure mailbox.

When needed for tax preparation purposes, tax practitioners may:

- Obtain an unmasked wage and income transcript if authorization is already on file by using e-Service’s Transcript Delivery System.

- Obtain an unmasked wage and income transcript by calling the IRS, if an authorization is not already on file, fax one to the IRS assistor and the IRS assistor will place the transcript in the tax practitioner’s e-Services secure mailbox.

The wage and income transcript is the only unmasked transcript that will be available to tax practitioners.

Reminder: Attorneys, Certified Public Accountants and Enrolled Agents (i.e. Circular 230 practitioners) can create an e-Services account and obtain access to the Transcript Delivery System and the e-Services secure mailbox, Unenrolled practitioners must either be responsible parties or delegated users on an E-File application.

The IRS urges tax professionals to register for e-Services or update existing e-File application information to ensure that all appropriate personnel have e-Services mailbox and TDS access.

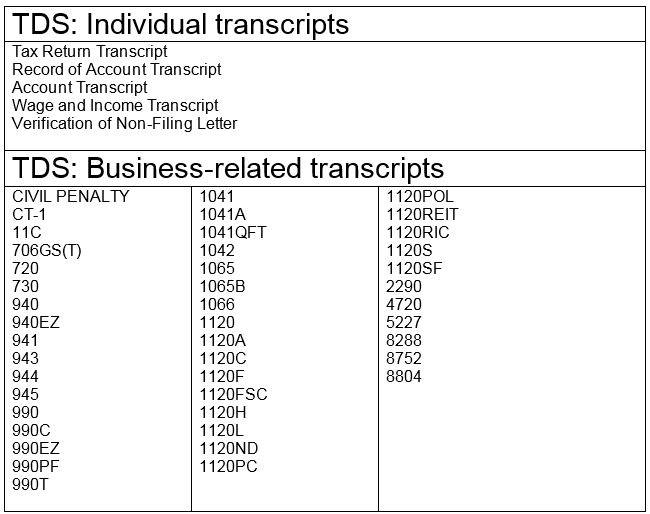

The charts below indicate the types of individual and business transcripts available via TDS: