By Jeff Drew and Ken Tysiac

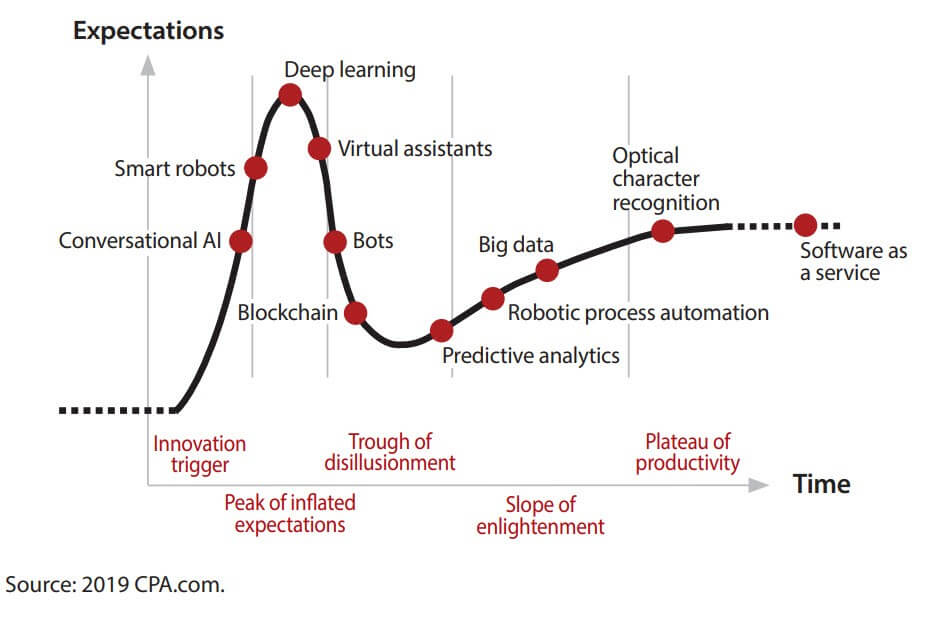

Accountants have heard for the past few years that technologies such as blockchain and artificial intelligence (AI) will bring radical transformation to the profession, changing everything from how audits are conducted and firms are structured to the type of work CPAs perform and the skills they’ll need to succeed. Transformation, however, has not been immediate, leading to some disillusionment among CPAs about the power and potential of new technologies (especially bots, blockchain, and predictive analytics, as shown in the graphic “CPA.com Accounting Profession Megatrends, 2019”; the graphic illustrates the cycle of expectations that technology innovations experience and shows where certain technologies stood in that cycle in 2019).

CPA disillusionment with new technologies brings to mind an oft-repeated quote by Microsoft founder Bill Gates: “We always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next 10.”

Those words, from Gates’s 1995 book The Road Ahead, seem particularly pertinent to the accounting profession as we begin the 2020s. Just consider how much the profession has changed over the past 10 years.

- In 2010, many expected that U.S. companies soon would be reporting under a global set of accounting standards after the SEC issued a statement encouraging the convergence of U.S. GAAP and IFRS. But enthusiasm over global standards quickly waned.

- Ten years ago, the Patient Protection and Affordable Care Act, P.L. 111-148, changed compliance rules, the Internal Revenue Code, and the health care industry in the United States. Although the law’s demise has often seemed likely, it has survived a Supreme Court decision and a repeal effort.

- The iPad debuted in 2010, a year when many CPAs were still using their first smartphone, and some were still using flip phones. The iPhone was first sold in 2007.

- A decade ago, very few firms were doing write-up work, which was written off as unprofitable due to the manual labor involved. Today, technology has automated most of the back-end work, transforming “write-up” into “client accounting services,” which now accounts for 10% of accounting firm revenues and is the fastest-growing segment of public accounting, according to AICPA research.

It’s difficult to predict what the regulatory future may have in store for CPAs over the next 10 years, particularly in an election year. But one thing is absolutely certain: Technology is going to bring huge changes in the 2020s.

“The past decade has been primarily about automating the inputs, such as the dynamic processing of expenses and bills, inputting of information to the general ledger, OCR [optical character recognition] reading of tax source documents, etc.,” said Erik Asgeirsson, president and CEO of CPA.com, the AICPA’s technology subsidiary. “Over the next five to 10 years, machine learning and predictive analytics will lead to a big boost in the sophistication of how this automated data is interpreted. This will allow the trusted adviser of 2030 to provide dramatically greater insights and actionable items for their clients and employers.”

TECHNOLOGY

As alluded to in the December JofA article “What to Expect in 2020,” the 5G cellular network and 5G-compatible device rollout will gain speed this year, hitting critical mass during the 2020s. The ability of 5G to transmit data at much faster speeds and in much greater amounts will open the floodgates to a torrent of information from what will be billions of devices connected to the internet. That data, in turn, will fuel the growth of AI, especially in the area of machine learning.

“Machine-learning algorithms use a large amount of what is known as ‘training data’ to make predictions or decisions without being programmed to perform the task,” said Rick Richardson, CPA/CITP, CGMA, founder and managing partner of Richardson Media & Technologies LLC.

Machine learning develops based on a simple equation. More data equals more learning. This formula already is producing results, such as when you interact with your smart speaker at home or receive personalized content recommendations on Netflix — or when doctors in China use AI to review millions of CT scans for early signs of lung cancer.

“It is not a far reach to consider a similar type of AI developed for common formatted financial statements,” Richardson said. This AI could have the ability to highlight anomalies in a current client’s statements based on thousands of other financials in the same industry, he said.

Paired with 5G cellular networks, devices connected to the internet of things (IoT) will generate enormous amounts of data that can be accessed in real time.

“If data is the new oil, then IoT devices are the new oil wells,” said Amanda Wilkie, a consultant with Boomer Consulting. She foresees a massive increase in real-time financial data driving the accounting profession toward predictive and prescriptive advisory services.

The access to real-time data analytics and analysis will give accountants the information needed to provide actionable intelligence and advice on business decisions.

“With these data insights, accountants can suggest immediate course corrections for businesses to forestall problems or identify new opportunities for growth,” said CPA.com’s Asgeirsson. “Technology will also help provide much greater assurance related to the overall integrity of business data.”

Blockchain will be another area where accountants will have the opportunity to add value. While blockchains will assist in the automation of business transaction tracking, businesses will need experts who can ensure that blockchains are running correctly — not just in technological terms but in terms of delivering the expected results.

Consider the case of smart contracts, which are built on a type of blockchain that automates the process of determining if the conditions of a contract have been met, thus triggering payment. CPAs could play a key role in assessing the operation of the blockchain to make sure each smart contract functions as both parties to the contract intended.

“Blockchain will lead to opportunities and new services for the profession as firms continue to evolve from compliance-focused accounting firms to problem-solving consulting and advisory firms,” Wilkie said.

How else will technology change the accounting profession in the next 10 years? Wilkie predicts that 5G will increase reliable broadband connectivity in rural and remote areas, shattering geographic barriers and giving accounting teams access to talent and business that were unavailable previously. Richardson expects jobs, the business environment, and technology to change so quickly that an individual’s capacity to acquire more knowledge will be more valued than the knowledge the individual already has. Richardson also foresees technology playing an increasingly important role in worker training and education.

“With widespread access to online and on-demand training, workers can be informed of skill updates while they work and will regularly tune up their education with the skills they need to remain relevant in the workforce,” he said. “Augmented reality will be used as a learning tool to improve the training of individuals or to recycle them in the job market.”

AI will play an increasingly important role in decision-making, Richardson said. Because it can learn from previous situations, AI will be able to automate complex decision processes based on data and past experiences. “There is a good chance that by the end of the next decade, the first AI machine will join a corporate board of directors,” he said.

AUDITING & ACCOUNTING

Audit fees will be one area to watch carefully as automated platforms take hold in the next decade. Audit clients presumably will be getting better service as technology audits entire datasets rather than just samples, and practitioners are increasingly able to deliver more insights based on the data analytics used in the engagement.

But while they receive more information from auditors than ever, CFOs and audit committees will realize that the human cost of delivering an audit is decreasing because some of the personnel will be replaced by technology. This may lead to a downward pressure on audit fees that will be a challenge for audit firms.

“At some point in time, I may be replacing audit staff with technology talent,” said Sean Lager, CPA, an audit partner at Frazier & Deeter in Atlanta. “Whether that talent is directly related to our audits or to a larger team of IT people I’ve got sitting back in the office, I need to allocate those costs to my jobs. My worry is, the market is going to see [technology-driven audits] and expect pricing to drop, when the reality is that the associated costs may not.”

Meanwhile, the skills that auditors need to have will evolve over the next 10 years. Jon Raphael, a partner and national managing partner of digital transformation and innovation at Deloitte & Touche LLP, said new work with technology will include interpreting recommendations from cognitive tools and evaluation of advanced analytics. This will help CPAs provide clients with more insight on decision-making. Audit staff also will need to have strong communication skills, as they will be in a position to explain data to clients and help them understand the numbers.

Specialists will be managing technologies and algorithms in addition to auditing client technologies that do not exist today, Raphael said. The result should be that audits improve in quality and deliver information to companies in a timelier fashion.

“Significant parts of the audit workflow, including working with audit technologies, will be centralized to take advantage of repeatable processes with highly trained professionals for increased quality,” he said. “Assurance will be broader in scope and more real time.”

PRACTICE MANAGEMENT

Practice management in accounting firms and company finance departments will face a challenge as organizational models shift to accommodate technology. Traditionally, these models have been shaped like a pyramid, with lots of less experienced workers at the bottom and firm or department leaders at the top.

But in the 2020s, technology increasingly will be handling a lot of the basic skills that young accountants performed upon first entering the profession. This could create a pipeline concern for firms.

“The technology, most likely, will replace staff,” Lager said. “And where do you think we get partners from? From our staff. They move their way up through the firm. So where’s our pool of talent going to come from? I don’t think the profession has any answers to that right now, so that’s a concern to me.”

It may be that the entry-level audit and compliance jobs of the past will morph into value-added or advisory roles for early-career CPAs. Jamie L. Wilkey, a partner at Lauterbach & Amen, said that over the past five years the Illinois-based firm with five partners already has experienced the beginning of this shift.

While traditional service lines of tax and audit have provided for a solid, profitable firm base, growth to the bottom line is coming from services where the firm can add value and expertise to a client’s operations. She expects that transition to continue.

“Technology trends will continue to provide improved efficiencies for compliance-related services that firms provide,” Wilkey said. “But expertise, an awareness of client needs, and an ability to formulate an efficient solution will be in high demand and is something that technology can’t replace.”

MANAGEMENT ACCOUNTING

The opportunities and risks associated with technology will make a holistic approach to risk management more important than ever over the next 10 years, according to Brenda Morris, CPA, CGMA, a partner at CSuite Financial Partners, a financial executive services firm.

“I recommend an ongoing, robust enterprise risk assessment process that is dynamic and that all key team members are engaged in,” Morris said, “and a strategic planning process that includes how to optimize existing technologies but also that has a forward-looking emphasis on what is in process and what is yet to come so they can be prepared to move at the appropriate time proactively, not reactively.”

The continued implementation of new technologies across organizations will require more collaboration among executive leaders over the next 10 years, said Sandy Cockrell, CPA, the manager of Deloitte’s CFO program. This could lead to a blurring of lines in the C-suite, he said.

CGMA thought leadership resources exploring the future of finance — including how business models are changing, the expanding role of the finance function, and how the mindset and role of the finance professional continue to evolve — can be found on the “Resources” tab of cgma.org.

Meanwhile, the disruption of the labor force resulting from the retirement of the Baby Boomer generation will continue to grow, according to Bob Sannerud, CPA, CGMA, the CFO of Life Link III, a provider of emergency air medical transportation based in Minnesota.

“Ten years from now the last of the Boomers will hit age 65 and be positioned to exit the labor market,” Sannerud said. “This will serve to continue the current employee shortage and continue pressure to do more with fewer resources — employees, money, hours of work.”

As the Baby Boomers leave the workforce, the profession will experience a demographic shift. The younger generations who replace the Boomers will be more diverse and have different priorities and ideals. Surveys of the members of Generation Z who are entering the workplace show that they prefer to work in a private setting rather than an open office, and they value feedback from their managers as well as inclusion with respect to gender, ethnicity, and sexual identity. Marianela del Pino-Rivera, CPA, founder of Del Pino Rivera CPA in Bowie, Md., said these changes will make it important for CPAs to develop cultural competencies in the coming years. Cultural competence is the ability to learn about and respectfully navigate multiple cultures whose values, beliefs, attitudes, customs, and languages are different from our own. Del Pino-Rivera said that getting out and working in diverse communities, asking appropriate questions, and most of all listening can aid in obtaining these skills.

“For example, in the Cuban community, business is done differently than in the Mexican-American community,” she said. “I think if you have a willingness to learn and you are willing to participate in some out-of-office events and just ask and listen, you will learn cultural competencies.”

TAX & PERSONAL FINANCIAL PLANNING

Automate but communicate: That might well be a slogan for CPA tax practitioners in the 2020s. Automation represents a blossoming to come of technologies now only in the bud. Technologies mentioned above, such as data analytics and AI, as well as automation of suitable tasks of tax return preparation, will continue to grow more prominent, CPAs said. Tax advising and client communications incidental to return preparation will continue to be conducted increasingly through digital channels, such as video chat or secure messaging. However, practitioners must maintain the traditional value of personalization. In that way, tax clients — and staff — will interact in ways they have come to expect in other business services contexts.

“The client interaction will continue to be more frequent and digital,” said Steven Kurinsky, CPA, CGMA, a tax manager and sorcerer of business services with DeLeon & Stang CPAs and Advisors in Leesburg, Va. “Most clients want an adviser they can call on multiple times a year, not just when their taxes are due.” In their more public personas, tax practices will increasingly rely more on social media for marketing and public relations, he added.

As for tax returns themselves, “Production of tax returns for business and individuals will continue to be automated,” Kurinsky said. “We should embrace the technology that will help do our data-entry roles so we can focus our time on higher-level work. A bot could replace our need to act as bookkeepers, but our clients will continue to seek our advice for business strategy, tax strategy, and business operations” (see also Kurinsky’s column “Tax Practice Management: Implementing Tax Automation and Digital Workflow,” The Tax Adviser, Sept. 2019).

Fixed-dollar fees will become more prevalent in personal financial planning in the next decade, according to David Oransky, CPA/PFS, a financial planner with Laminar Wealth in Chesterfield, Mo. He said that the rise of technology will make it difficult for personal financial planners to provide value solely by managing investment portfolios.

Advisers will need to increasingly focus on optimizing clients’ financial lives and minimizing taxes, Oransky said.

“As services and the value provided expand beyond investment assets, consumers and advisers will both begin to question the validity of asset-based fees as an appropriate proxy for the value of the relationship,” Oransky said. “We’ll see more fixed-dollar fees, which place less emphasis on the size of the managed portfolio and more on the complexity of the client’s financial life.”

The importance of social responsibility to today’s younger generations also will be a part of the change of focus for personal financial planners, according to Susan Tillery, CPA/PFS, president and co-founder of Paraklete Financial in Atlanta.

“The personal financial planning profession, families, and communities will be transformed by putting families and community first,” Tillery said. “Family mission statements and accompanying goals will focus on both family and community, and the client’s financial plan will support the client/family life plan.”

EVOLUTION OF CPA

In anticipation of the changes that are coming for the CPA profession in the 2020s and beyond, the AICPA and the National Association of State Boards of Accountancy are working to evolve the initial CPA licensure requirements. This CPA Evolution project will continue into 2020 and is designed to help the profession continue serving the public interest while supporting business needs that are changing rapidly.

The changes will be reflected in accounting academia, as well, as colleges and universities continue adapting their curricula to help students develop the skills that will be most useful to them in the profession. Part of that adaptation will include updating the curricula to integrate technology skills that are becoming essential in the profession. The evolution of accounting course work will occur as educators in all fields will be challenged to adapt to new technology-enabled delivery methods, as online degrees and classes seem destined to grow in popularity.

Material tested on the CPA Exam also will continue to reflect the changes. The AICPA Examinations team has developed mechanisms to make sure the CPA Exam Blueprints that describe the competencies to be tested are updated as frequently as necessary to contain the information newly licensed CPAs need to know to perform in their jobs.

Meanwhile, individual CPAs will continue to evaluate opportunities as they arise and learn new ways to capitalize on technology-enabled processes.

“I think the CPA is going to look a lot different 10 years from now,” Lager said. “What we do for the public is going to be a lot different.”

Originally published by Journal of Accountancy.