By: Douglas Beelendorf

On January 16, 2014, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2014-02, Intangibles—Goodwill and Other (Topic 350): Accounting for Goodwill. ASU 2014-02 introduces an accounting alternative for private companies that simplifies and hopefully reduces the costs associated with the subsequent accounting for goodwill. Private companies that elect the accounting alternative will now be able to amortize goodwill on a straight-line basis over a period exceeding 10 years. The 10-year amortization period is a default period for which no further justification is necessary; however, private companies may choose to identify and use a shorter useful life if it can demonstrate that such a useful life is more appropriate.

Along with electing the accounting alternative, a private company is required to make an accounting election with respect to whether it will perform its goodwill impairment testing at the entity level or at the reporting unit level (as per the previous guidance). Under the new accounting alternative, goodwill should only be tested for impairment when a triggering event occurs, which may indicate that the fair value of the entity (reporting unit) is below its carrying amount. FASB Accounting Standards Codification® (ASC) 350-20-35-3C, provides several examples of potential triggering events, including:

- A deterioration in general economic conditions

- An increased competitive environment

- Negative or declining cash flows

- Changes in key personnel

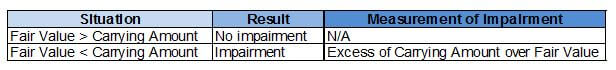

If a triggering event has occurred, the private company has the option to first perform a qualitative assessment to determine if it is more likely than not, that the fair value of the entity (reporting unit) is less than its carrying amount. This step is completely optional for the private company and may be bypassed to proceed directly to a quantitative assessment. If the private company has determined that it is more likely than not (greater than 50% likelihood) that the fair value of the entity (reporting unit) is less than its carrying amount based on the qualitative assessment, or if the private company has decided to bypass the qualitative assessment, then it must proceed to a quantitative assessment. The quantitative assessment compares the fair value of the entity (reporting unit) to its carrying amount, including goodwill.

The new accounting alternative no longer requires the private company to perform the two-step quantitative goodwill impairment test, which requires a hypothetical business combination, accounting for purposes of measuring the impairment loss. Keep in mind that the amount of the impairment loss cannot be more than the carrying amount of the goodwill.

Reminder: If the accounting alternative under ASU 2014-02 is elected, all aspects of the alternative must be elected. In other words, a private company cannot elect to apply the impairment guidance and not elect to apply the amortization guidance. In addition, the accounting alternative must be elected for all goodwill recorded by the private company, not just selective groups of goodwill.

Effective Date: While ASU 2014-02 is not effective until annual periods beginning after December 15, 2014 (calendar 2015), and interim periods within annual periods beginning after December 15, 2015 (calendar 2016), early adoption is permitted. As such, private companies may elect the accounting alternative to account for goodwill in their 2013 financial statements, as long as those statements have not yet been made available for issuance.

Prior to making the election to adopt the accounting alternative, a private company needs to carefully consider the possibility of becoming, or being acquired by, a public business entity in the future, as discontinuing the election would currently require (absent additional standard setting) retrospective application of the legacy goodwill accounting model (i.e., the goodwill accounting model applicable to entities that cannot elect the accounting alternative). A private company also needs to be certain that the users of its financial statements will accept financial statements in which the accounting alternative has been applied.

Doug is an assurance partner with McGladrey’s National Professional Standards Group (NPSG) and is located in the Greensboro, North Carolina office of the Carolinas practice. He serves as a Subject Matter Expert (SME) in the areas of business combinations and consolidations. Doug actively serves on both interoffice inspection quality control review and due diligence review teams for the Firm. Doug also develops and delivers both internal and external professional education on behalf of the Firm.

In addition, Doug has served as the director of financial accounting and SEC reporting for a large, publicly traded international textile company. In this capacity, Doug has extensive experience in financial accounting and reporting, as well as business planning, employee benefit plans and financial systems implementations.

Doug is also a member of the NCACPA Accounting & Attestation Committee.