Some paths are roundabout, some have detours, and some are just full of unexpected twists and turns. Such is the pathway for a CPA. No two paths are alike, and in this feature we highlight the unique journeys and perspectives of our members with not only a CPA credential, but often an unconventional story of how they came CPAs.

Some paths are roundabout, some have detours, and some are just full of unexpected twists and turns. Such is the pathway for a CPA. No two paths are alike, and in this feature we highlight the unique journeys and perspectives of our members with not only a CPA credential, but often an unconventional story of how they came CPAs.

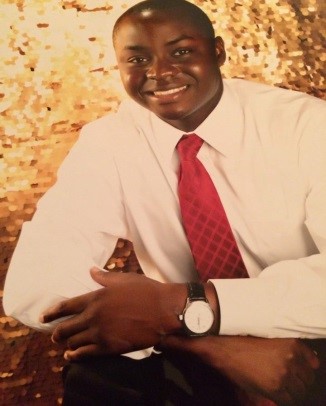

Today we hear from James Robinson, a member of the Young CPA Cabinet who works at RSM in risk advisory services—a relatively new but increasingly important field for businesses.

What is your educational background?

I attended NC State University from 2008-2012 and obtained my bachelor’s degree in accounting. Additionally, I obtained my master’s degree in accounting from Wingate University.

What is your current position, and what other positions have you held in accounting?

Currently, I am a senior associate in the Risk Advisory Services practice of RSM US LLP, in Charlotte, NC. I focus specifically on Internal Audit/Sarbanes-Oxley (SOX) and IT Sarbanes-Oxley (SOX). I am responsible for reviewing, documenting, and testing IT and operational internal controls. Additionally, I am responsible for conducting fieldwork, discussing observations during exit meetings, preparing work papers to support conclusions, and preparing formal written reports for issuance to clients.

I actually started at Deloitte as an Audit Intern in 2012 then I realized that with an audit, there is also a financial statement and an IT component, which interested me. So, I asked if I could learn the IT side of an audit and get involved in the Risk Advisory practice. After I joined and gained some experience in the IT Risk Advisory practice, I realized that I wanted to pursue my career in that area.

How has your career path changed from what you first expected or envisioned for yourself?

The biggest change that I have had since the beginning of my career was leaving Big Four public accounting after my first year of work and working at RSM. However, it has been the best thing since I moved to RSM.

Why did you choose to become a CPA over other career options?

I actually am an odd basket in that I knew since high school I wanted to be a CPA, when I had an accounting course and everything just clicked. Additionally, I was highly involved in DECA throughout high school with great advisors, and was my chapter’s president. After I finished high school, I pursued my passion and attended NC State. I knew that I didn’t like economics and wanted a degree that was more focused than business administration. Thus, I chose to obtain my degree in accounting and pursue my passion of becoming a CPA.

What advice would you give yourself if you could go back and do it all over?

I would utilize my relationships with my professors more.

How has your NCACPA membership helped you in your career journey?

NCACPA has helped my career in so many different ways. Ever since I joined, I have been able to participate in trainings that have advanced my career and have been able to meet young CPAs through social events and NCACPA Young CPA Cabinet meetings. Through the Young CPA Cabinet, I have been able to get involved in several NCACPA events (i.e., speaking at the CPA Inauguration dinner) and joining the newly formed Risk Advisory Services committee.

We love to share our members’ stories! Would you like to share your pathway to becoming a CPA? Email Carly Rutledge at [email protected] if you are interested in this feature or writing on another topic for the NCACPA blog and/or magazine.