By Tim Huggins

Managing CPA liability risk exposures is a complex process, and it’s easy to underestimate the potential for risk along the way. The following six mistakes can be avoided by being aware and taking the right steps.

1. Not discussing questions about the insurance application with your underwriter or agent

Whether it’s for a new or renewal policy, the better the job you do with the application, the better your chances for avoiding mistakes and problems. Take time to review the questions and determine what information and data you will need for it. State the information accurately. Applications are not opportunities to market or embellish your firm’s profile. Misstatements may result in a higher premium or even the rescission of a policy based on wrong information. Some companies encourage CPAs to call their underwriters or agents with questions about the application and the information requested. A phone call is an easy way to correct errors before they occur.

2. Not having appropriate policy limits for your firm profile

Excessively high limits of insurance offered at bargain prices are red flags. High limits will often put a bigger bullseye on your firm and potentially lengthen the claims process. However, you also need to carry enough limit to be able to protect yourself in the event of a bad claim, or to fight a frivolous claim. A specialized underwriter, agent, or account executive can discuss your firm’s specific risk exposures, policy limits, and coverage options. Each accounting practice is unique—tax specialists have exposures that are different from those of auditors. An underwriter or agent experienced in CPA firms will work with you to create a policy that addresses your specific risk areas, with the appropriate limits and cost structure.

3. Admitting liability, assuming damages, voluntarily making any payments, or incurring claims expenses

These are all actions a CPA firm must avoid without the prior written consent of the insurance company. Such actions will likely violate policy conditions, which may result in a denial of coverage. Policyholders should not take action without first receiving guidance from a risk adviser with the insurance company. Avoid agreements that include “hold harmless” or indemnification provisions that are one-sided and not in the firm’s favor. Firms that go along with clients in attempting to handle a problem internally without reporting it are sometimes surprised to find out later that the problem is much larger than it appeared to be. If the problem was not reported timely in accordance with the policy, the damages might not be covered.

4. Not reporting a potential claim as early as possible

The sooner claims and potential claims are reported, the more effective an insurer can be at achieving an early resolution. Early reporting will also help assure coverage for the potential claim. Some insurers encourage the early reporting of claims by reducing the deductible for any potential claim that is reported before a claim is made. Further, if it is determined that it is appropriate to retain legal counsel to assist with a pre-claim situation, some insurers will absorb the legal expenses, help policyholders achieve a resolution with the client, prepare a tax penalty abatement request, draft talking points for communicating the facts of the situation with the client, and provide subpoena and other services if the need arises.

CPAs are often so busy that they don’t recognize or acknowledge a potential claim as it is developing. This can be particularly devastating when the damages claimed are significant and are not covered because of late reporting. It’s important for CPAs to pay attention to potential issues and to report to their carriers as soon as they think there may be a problem. Also new for CPA firms is “continuity of coverage,” which permits much later reporting by a CPA firm that has consistently renewed with the carrier, even if the firm knew of a potential claim but did not report it until the client makes an actual claim months or even years later.

5. Not utilizing the insurance program’s advisory, loss prevention, and risk management services

The best way to avoid a claim is to manage the risks that lead to claims. Some of the basic risk management tools, such as client screening, engagement letters and follow-up documentation, are crucial in managing potentially major problems into minor problems. The more tools and resources an insurance program provides its policyholders, the better those policyholders will be at avoiding or minimizing problems and disputes. A good insurance program will also advise you on how to utilize its resources to help your firm improve its practices. You can also get a good feel for a company’s service and attitude toward its policyholders by using its services. If you are interested in a good partnership with your company, the company should do its best to help you minimize your losses and control your premiums.

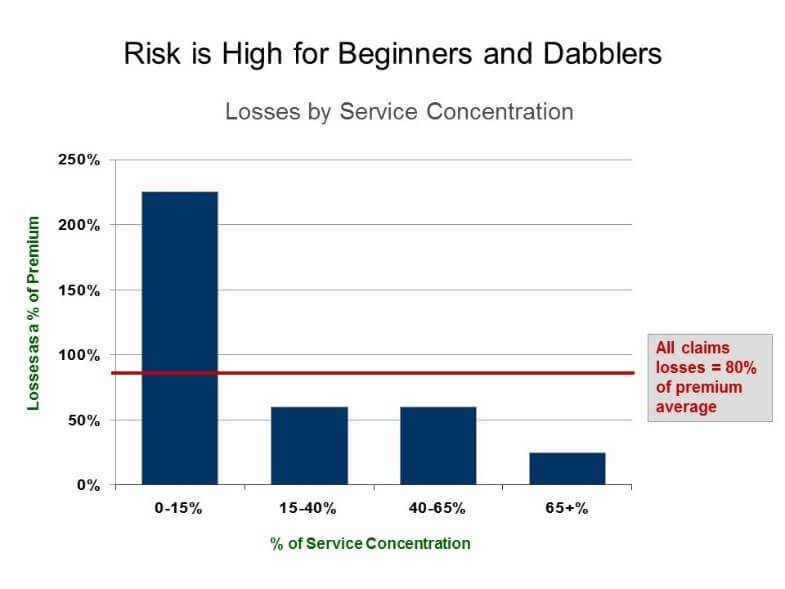

6. “Dabbling” in high-risk work without doing enough to stay proficient at it

Claims data show high loss ratios for services that comprise less than 15% of a firm’s work. By the same token, loss ratios are low for services that comprise 65% or more of a firm’s work. (See chart on “Risk is High for Beginners and Dabblers.”)

Also, part of the client screening process includes making sure that the engagement is a good fit for the firm’s expertise. Proficiency in any type of engagement includes the ability to identify risk stress points in the engagement. CPAs are expected to possess a thorough understanding of the client’s business and industry in order to identify those stress points. Establish a policy for what types of engagements the firm will avoid because of a lack of technical expertise. Some firms will write a description of the engagements they accept and the way they conduct business and perform services, including steps for controlling liability exposures (such as engagement letters and other forms of documentation).

The CPA firm should always feel comfortable about contacting its liability carrier and asking questions about any matters, regardless of how small they may appear to be. If the company is committed to providing good services and helping CPAs solve problems, you will discover this just by reaching out with an email or phone call.

Tim Huggins is manager of underwriting operations with CAMICO, responsible for underwriters and underwriting department activities. He joined CAMICO in 1998 and was promoted to senior underwriter in 2005, responsible for CAMICO’s largest direct accounts. Huggins earned a bachelor’s degree in business administration from Capella University. Prior to joining the insurance industry, he worked in various capacities in the business environment, including the high-tech industry.