By: Ken Brackney

Can acquirees in business combinations adopt the same new basis of accounting the acquirer uses? The Financial Accounting Standards Board recently published a consensus position from the Emerging Issues Task Force (EITF), ASU 2014-17, Business Combinations (Topic 805): Pushdown Accounting, to answer this question. The standard establishes new and common guidance on applying pushdown accounting for public and nonpublic acquirees. The Securities and Exchange Commission (SEC) simultaneously released Staff Accounting Bulletin 115 to rescind the existing guidance for public acquirees. This blog entry summarizes the main features of the new standard.

Pushdown accounting is a procedure whereby the acquiree in a business combination adopts the same new basis of accounting the acquiring company uses for the acquiree in the initial set of consolidated financial statements. In effect, the acquirer’s new basis for the acquiree is “pushed down” to the acquiree’s separate financial statements. The acquiree recognizes the same assets and liabilities the acquirer does in applying the acquisition method, and it measures them the same as well. This procedure is rooted in the idea an acquisition transaction offers objective evidence of the collective fair values of the acquiree’s assets and liabilities.

Previously, the SEC provided guidance to public acquirees, but the guidance varied significantly depending upon the acquiring company’s ownership percentage. Generally Accepted Accounting Principles did not offer any guidance to nonpublic acquirees. The new standard establishes common guidance for all acquirees. The standard applies to businesses and nonprofit activities, and their subsidiaries as well.

ASU 2014-17 permits an acquiree to elect pushdown accounting for use in its separate financial statements. The threshold for considering the election is a change-in-control event, meaning an acquiree may elect pushdown accounting upon being acquired. The EITF settled on the familiar control benchmark, majority ownership. Acquirees may consider the election event-by-event, and they may adopt the new basis of accounting even when the acquirer is exempted from doing so. Once made, the election to adopt is irrevocable.

The standard gives recognition and measurement guidance for acquirees electing pushdown accounting. An acquiree must:

- recognize all identifiable assets and liabilities at their acquisition date fair values, with the net offset reflected in Additional Paid-in Capital;

- recognize any goodwill, with the offset reflected in Additional Paid-in Capital;

- recognize any bargain purchase difference as a direct adjustment to Additional Paid-in Capital; and

- recognize any acquisition-related liabilities that represent obligations of the acquiree.

The standard requires acquirees electing the new basis to supply disclosures similar to those required of an acquirer in a business combination. In addition, the acquiree must supply certain information on the effects of applying pushdown accounting:

- the amounts recognized for each major class of assets and liabilities; and

- for a bargain purchase, the amount recognized in Additional Paid-in Capital and a qualitative description of the source(s) of the bargain purchase.

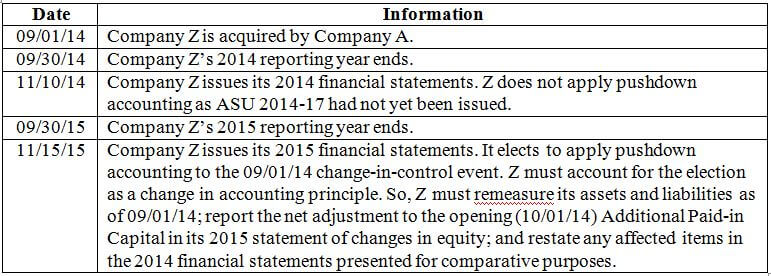

ASU 2014-17 took effect upon issuance (November 18, 2014). The transition provisions offer considerable flexibility for acquirees. An acquiree may apply the new standard prospectively, meaning to future change-in-control events occurring after the effective date. If an acquiree forgoes adopting pushdown accounting in the period a change-in-control event occurs (say in 2015), it may elect the procedure in a subsequent period (such as 2016). In the subsequent period, the acquiree must treat the delayed adoption as a change in accounting principle. ASU 2014-17 also gives acquirees opportunity to apply the new standard retrospectively, to the most recent change-in-control event occurring prior to the effective date. Consider the following example:

The new standard places the decision to adopt pushdown accounting with individual acquirees. Each acquiree must assess whether adopting the new basis of accounting will enhance, or diminish, the usefulness of the financial statements for its particular stakeholders.

Ken Brackney, PhD, is the Harlen E. Boyles Professor of Accounting at Appalachian State University. He teaches and researches in the areas of financial accounting and international accounting. He received his bachelors and masters degrees in Accounting from Old Dominion University and his doctorate in Accounting from UNC–Chapel Hill. He holds a CPA license from the Commonwealth of Virginia.

Ken Brackney, PhD, is the Harlen E. Boyles Professor of Accounting at Appalachian State University. He teaches and researches in the areas of financial accounting and international accounting. He received his bachelors and masters degrees in Accounting from Old Dominion University and his doctorate in Accounting from UNC–Chapel Hill. He holds a CPA license from the Commonwealth of Virginia.