By David Deull, Principal Economist, IHS Markit

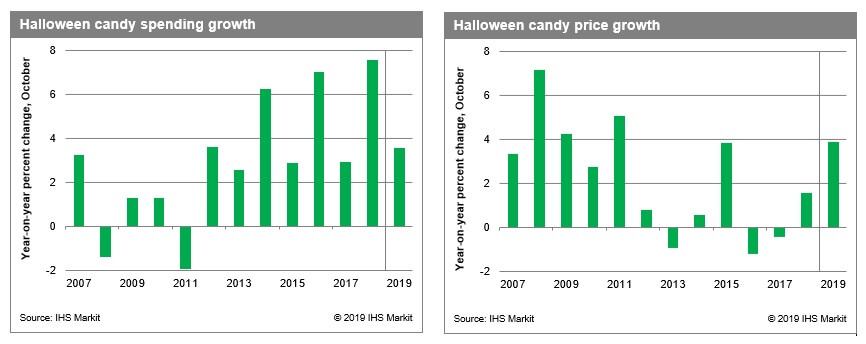

- IHS Markit is forecasting 2019 Halloween candy prices to rise 3.9% over last year, which would be the fastest increase since 2011.

- We define Halloween candy price growth as the change in the October not-seasonally-adjusted Consumer Price Index for candy and chewing gum.

- Halloween candy spending is expected to increase 3.6% over last year, reaching a total of $2.7 billion—a deceleration after last year’s 7.6% growth.

- We define Halloween candy spending as estimated October seasonally adjusted personal consumption expenditures on candy and chewing gum.

The tradition never dies – dropping gobs of cash on delicious confections and ghastly getups for Halloween. This year, Americans will likely outdo themselves; we are forecasting Americans to spend a total of $2.7 billion on Halloween candy in 2019, the most yet.

Candy spending screamed ahead with an eye-popping 7.6% jump last year as fiery economic growth produced a sugar high for candy consumption. Year-on-year growth of real disposable income peaked at 4.1% in the third quarter of 2018, giving households some extra money to burn. This year, things are a little different. Third-quarter real disposable income growth over the year before is estimated to have slowed to 3.0% in 2019. It would be a real trick if households repeated last year’s monster haul. Still, we are forecasting spending on Halloween candy to lurch forward in 2019 with a 3.6% increase. Such a performance would mean an average of $21.30 spent on Halloween candy per (haunted) household.

Candy prices are looking scarier this year. Candy price increases were frightening between 2005 and 2011, during which each year saw growth of 2% or more. But the next eight years brought a lifeless performance for candy prices, and only one year (2015) saw a greater-than-2% gain. Price growth was underground in 2016 and 2017, when the cost of Halloween candy fell, and it turned around in 2018 with a 1.6% increase. This year, candy prices are coming alive again. We are forecasting a blood-curdling 3.9% jump in Halloween candy prices in 2019 – the most in eight years.

Whodunit? It’s not sugar; US refined cane sugar prices are about the same as they were this time last year, while beet sugar prices are slightly lower. It’s not cocoa prices, which are also in a similar place as they were a year ago. Although the Ivory Coast and Ghana are setting up production limits and other policies to prevent overflowing supply, other cocoa producers have not been spooked, and cocoa processing continues to grow in Asia, North America, and Africa, while current cocoa volumes remain up. Milk is the first suspect: the Producer Price Index for raw milk has grown at a chilling pace for much of the year. Second, candy prices are haunted by the rising cost of labor. This September, the twelve-month growth rate of average hourly earnings of food manufacturing production workers was 5.0%, the most on record since 1991.

Candy spending growth has jerked around like a thrill-ride in the last five years. It went on a spree in 2014 (up 6.3%), then grew only 2.9% in 2015. When 2016 came rolling around, a 1.2% dead drop in candy prices shot spending sky-high with a 7.0% gain. Another uninspired year of 3.0% growth followed, setting up 2018 to show more spirit with 7.6% growth.

This year Halloween candy spending will continue to be animated by elevated consumer confidence, strong employment markets, and real disposable income growth, despite the ominous clouds of trade wars and uncertainty that hang over the horizon. On top of 2018’s bon-bonanza, even the more moderate 3.6% growth we are forecasting for 2019 will have little witches and pirates gobblin’ down plenty of goodies.

Trick or treat? This year, the cost of a treat is rising, and a dollar won’t go quite as far. But consumers still have a few tricks up their sleeve, including bountiful job prospects and consumer confidence that won’t die – allowing them to treat themselves a little more in turn. This year’s forecast: treat!

Originally published by IHS Markit