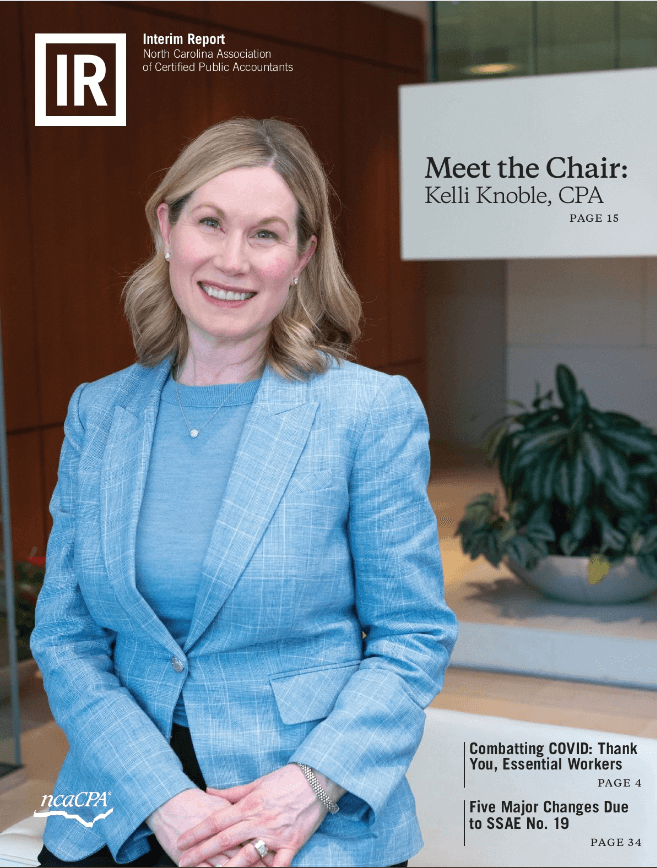

Due to social distancing requirements, this year’s “Meet the Chair” interview was a bit unconventional. With Kelli seated on her back porch to escape her quarantined college kids, and me stationed in my room with the door closed, pleading my dog not to bark, Kelli walked me through her life story via Skype. We discussed everything from her odd summer jobs in college to her work in tax/advocacy. On behalf of NCACPA, we warmly welcome Kelli Knoble, CPA, as NCACPA’s 2020–21 Chair.

Embracing Change Early On

It’s said that your childhood affects your success as an adult. If I’d asked Kelli her thoughts on this, I think she’d agree with the statement. Kelli approaches change with open arms and encourages people to “be open to opportunities, learning as much as you can at each one.” Her father certainly had a similar view when he relocated their family to the rural roads of Concord, NC when Kelli was just 10 years old.

“It was a little bit like the city mouse that went to the country,” Kelli said reflecting on the move. “My father wanted to move back to the small-town life and give us kids a different experience.” Living among farm country complete with a rural route box (akin to a mailbox) and tractor, you may be wondering how Kelli found her way into the profession. As it turned out, her connection was living under the same roof.

Procuring the One—and Only—Job

“Neither of my parents finished college, but they had a little bit of secondary schooling. My mother worked in an accounting department and I met a lot of people through her,” said Kelli considering her evolving connections in the ‘80s. One event that sparked her interest in the profession was the 1986 Tax Act. “One of the things that really interested me was the

influence of legislation on driving both corporate and personal behavior in the economy. That was why I pursued accounting; one for the more certain job prospects, and because I love the concept of tax policy and the impact it can have on our economy and society.” Kelli’s fervent interest in tax policy hasn’t faltered to this day.

Her career began at the University of Chapel Hill where Kelli was enrolled in what was called a 3/2 program. Through this

program, Kelli earned her bachelor’s and master’s degrees over the course of five years, spending the time between semesters working odd jobs. “I had all kinds of crazy summer jobs. One year I worked on a field crew for a plant nursery where we propagated plants and another summer, I worked in a coupon clearing warehouse. Just by leveraging contacts, I would have very different summer jobs. It taught me so much about the way different businesses run. I think at the time, it was actually more valuable to me than the very rare accounting internships people procured.”

Despite summer work as a student, Kelli has really only had one job. In 1992 following graduation, she accepted a position as a tax staff accountant at Arthur Andersen. In hindsight, Arthur Andersen connected Kelli to two transformative opportunities: a job that would lead to a prosperous career and her future husband David Knoble. Kelli and David met at Arthur Andersen while the two were on their way back to UNC after a recruiting trip. “He was in the audit practice and I was in the tax practice, and so we met attending the recruiting events together,” recalled Kelli. Two year later, they married in the fall of 1994. To this day, Kelli and David share a love for the accounting profession. “We’re both very passionate about our work and giving back to the profession that has given us a very good lifestyle,” remarked Kelli whose entry into the profession began at a former “Big Five” firm.

Toys & Taxes

Following graduation, Kelli started a job—amidst a minor recession—at Arthur Andersen and was proud to become its first state and local tax associate in the Carolinas. Kelli spent most of her technical career focused on state and local tax issues which was, as Kelli described, “an exciting place to be in the ’90s.”

With legislative activity at a high among the states, her passion for tax flourished by the day as she gained knowledge and experience through tax planning and restructuring. At the start of her career, one of Kelli’s most resounding experiences, oddly enough, involved a giraffe.

For anyone familiar with Kelli’s love of animals, it’s unsurprising that her fervent interest in tax was propelled by a four-legged creature. Only this creature—more specifically a giraffe—was actually a Toys R Us logo named Geoffrey.

Geoffrey caused quite the uproar in the 1990s during a famous South Carolina tax case in which the state started to tax companies where their intellectual property was used. “It was a really interesting and exciting time to be in state and local tax, helping companies plan and operate, and then be very responsive to legislative activity” shared Kelli. To put it in perspective, Kelli explained “Wayfair is similar to what Geoffrey was to me when I started my career.”

Making Partner AND a Family

The next step in Kelli’s career was made for her when most of the Arthur Andersen practices in the Carolina’s joined Grant Thornton in June 2002. “ It was a challenging time in the country and in the profession, but one of the most impactful experiences was seeing the bonds of our team stay together in a new firm.” Today, she works with some of the same people she has for over 27 years! “I think that’s one of the more notable things about my career, the fact that many of us have been together through two firms, and a lot of years!”

Surprisingly, Kelli hasn’t always anticipated a life-long career in tax. “Back in the ’90s, as a working mom, I thought I would leave the profession after my second child was born.” She wasn’t alone in this mentality. Kelli and a few of her peers proposed a part-time working arrangement to their tax management team at Arthur Andersen. Their request was both approved and supported.

While we casually refer to this today as a flexible work arrangement, Kelli and her coworkers had to advocate for this flexibility on their own during a time when there were very few role models for working moms in the profession. “We were really the pioneers of that for Andersen and the profession at the time.” Kelli explained that this cultural benefit transcended to Grant Thornton as well where she worked part time for 10 years. While working part time and raising two young boys, Kelli made partner. Following this immense achievement, Kelli returned to a full-time schedule in 2009 to take on new leadership roles.

Pursuing a Passion for Advocacy

It was at this point in her career that Kelli also began dedicating more time to advocacy. As a partner at Grant Thornton, she was able to work with their public policy group and visit Capitol Hill. Kelli said she’s “fascinated by the fact that our legislative bodies are so interested in understanding company’s and individual’s perspectives.” This likely stems from her passion for problem solving—which she revealed is what she enjoys most about her work. “I love solving problems. Whether that is for our clients or our firm and workforce, I enjoy being creative and really helping companies and individuals achieve their goals.”

When it comes to resolving challenges in the profession, Kelli advocates by providing a state tax policy standpoint. She’s drawn to causes like state tax policy which is a driver for bringing business into the state. “That’s a real interest for me, because obviously drawing more business into our state is good and it’s also good for our accounting profession in terms of all the support and consulting we can do for companies.”

Kelli said her reason for joining NCACPA and engaging in advocacy work was “to give back to the profession that has been so good for my family.” Though her intention was to support the association, Kelli credits NCACPA as having “given more to me, to my own surprise.” Like many, what she values most is the connections she’s made and the ability to engage with people across the state.

Becoming Chair Amidst a Global Pandemic

To say Kelli assumed the role of chair during changing times is a grave understatement. Following the association’s centennial anniversary, revised vision and mission statements, and amidst a global pandemic, Kelli’s optimistic attitude toward change is encouraging. “One of the greatest things about being in the accounting profession is the constantly changing environment. It’s a matter of being really adaptable and responsive to change, not just letting it pass you by.”

Still, there are changes even Kelli could not have prepared for. “Austin never imagined he would end his term in the midst of a pandemic, and I never imagined I would begin my term in a rapidly evolving virtual environment.” Prior to the pandemic, Kelli was focused on the sustainability and future of the profession. And now? Well, Kelli believes these topics may actually be even more relevant as business operations adapt to fit the current situation.

“Being designated an ‘essential service’ comes with great responsibility to our community. Many of our professionals are working harder than ever to consult and guide clients and organizations through the economic challenges and stimulus opportunities,” said Kelli. Despite the increased workload, she identified positive findings during these difficult times. “From a public accounting perspective, we’re learning a lot more about our client’s businesses, and being able to really understand goals and opportunities to help our clients.”

On a more personal level, Kelli admits that in a profession which tends to exhibit a bit more formality, “it’s really nice to see more casualness and personal engagements. We’re getting to see the insides of people’s houses, their pets, and their children. While [the pandemic] is very challenging and has a tremendous negative impact, I think being able to experience something together as a community, and relate to each other around a central theme, is a unique bonding experience for all of us.

As we look forward to overcoming newfound challenges and establishing a “new normal” in both our professional and personal lives, we could not have found a more opportune leader. NCACPA is proud to welcome Kelli Knoble as the 2020–21 NCACPA Chair.