By David Peters, CPA, CFP

It has been well documented that the problem of financial illiteracy is widespread throughout the United States. According to a recent article on dailyfinance.com, only 40% of adults actually budget or track their spending, over 75% of families live paycheck to paycheck, and over 25% of families have no savings at all (Bera, 2014). These statistics send a clear message to financial professionals all over the state of North Carolina, as well as the country—people need our help. Our communities, our friends, and our neighbors need the benefit of our financial knowledge and skills.

If you are like me, you may hear this call to action, however, you may struggle with how to respond. After all, there seems to be an overwhelming number of organizations that promote financial literacy causes, yet they all seem to be going in different directions. While we all agree that we need to do something to improve financial literacy in our world, we seem very fragmented (and ultimately, less effective) in our approach. It would seem that a more united front among financial professionals is not only warranted, but necessary if we are ever going to make a difference in the ever-growing problem of financial illiteracy in our communities.

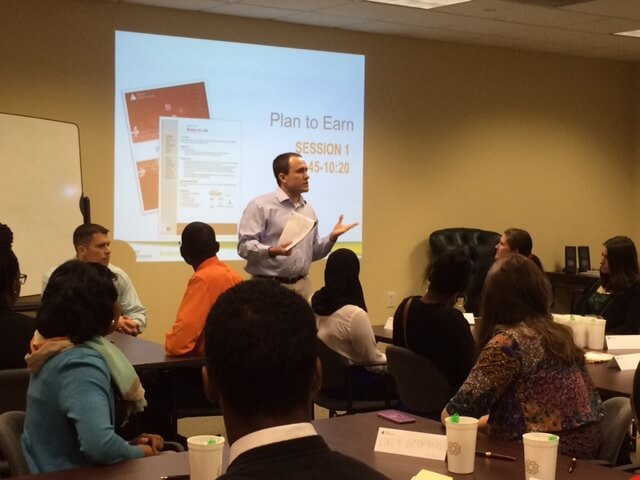

Last week, my company, Carroll Financial, hosted a group of 23 students from Myers Park High School in our office in Charlotte for a day of personal finance education. Throughout the day, several NCACPA volunteers and financial advisors from Carroll Financial led students through the Junior Achievement Personal Finance curriculum. Students participated in exercises on budgeting, credit, and long-term financial planning. Financial professionals from the community facilitated small group discussions with students that enabled them to ask questions and further explore how the topics presented related to their own lives. The level of engagement from the students of Myers Park was phenomenal! Students asked questions about saving for retirement, paying for college, and even how to calculate a credit score. The range and quality of the discussions are a testament to both the Myers Park students asking the questions, as well as the volunteers who gave of their time to answer them.

What made the event special was that it combined the talents of several groups. Junior Achievement of Central Carolinas provided the curriculum and helped coordinate the event. NCACPA helped get the word out to the CPA community in Charlotte and provided lunch for students and volunteers. Carroll Financial provided volunteers and hosted the event, giving the students the opportunity to spend time within an office environment. Without the efforts of all three groups, the event could not have been such a great success!

The JA Symposium at Carroll Financial this past week was only one event—one small dent in the very large problem of financial illiteracy. However, it definitely showed the impact that can be made on students and the community when the talents of several organizations come together for a common good. All the volunteers that were involved can’t wait for fall to come and the school year to begin—so we can do it all again, and make another dent.

David Peters, CPA, CFP®, is the Strategic Relationship Manager and Financial Advisor for Carroll Financial Associates, Inc., in Charlotte, N.C. He is also an adjunct professor in accounting, insurance and ethics, and a doctoral student in financial planning. Contact him at [email protected]. Website: www.carrollfinancial.com

David Peters, CPA, CFP®, is the Strategic Relationship Manager and Financial Advisor for Carroll Financial Associates, Inc., in Charlotte, N.C. He is also an adjunct professor in accounting, insurance and ethics, and a doctoral student in financial planning. Contact him at [email protected]. Website: www.carrollfinancial.com

The information discussed herein is general in nature and provided for informational purposes only. There is no guarantee as to its accuracy or completeness. Nothing in this article constitutes an offer to sell or a solicitation of any offer to buy any type of securities.

Registered Representative of and securities offered through Cetera Advisors Network, LLC, Member SIPC/FINRA. Advisory services offered through Carroll Financial Associates, Inc., a Registered Investment Advisor. Carroll Financial and Cetera Advisors Network, LLC are not affiliated.

Works Cited

Bera, S. (2014, April 18). The Scary State of Financial Literacy in America. Retrieved May 4, 2016, from dailyfinance.com: https://www.dailyfinance.com/2014/04/18/the-scary-state-of-financial-literacy-in-america/