By Rick Telberg

CPA Trendlines Research

Drilling into firm technology and operations provides a roadmap for strategic success.

Every day in the United States, more than half of all accounting firm owners are thinking about a merger, an acquisition, or both. M&A is now as routine to the day-to-day operations of running a tax and accounting practice as turning on the lights in the morning and taking out the garbage at night.

Fortunately, the new Accounting Firm Operations and Technology Survey by the research team of Randy Johnston and Leslie Garrett provides a one-of-a-kind roadmap for growth-minded professionals seeking the hard-boiled data essential to making smarter strategic decisions. With thousands of key metrics for firms of every size, you can compare your firm against similar firms. Better yet: You can compare where your firm is today to where you want it to be tomorrow.

Beyond displaying a snapshot of the status quo, the survey offers the real-world data points that can build solid strategic plans—for organic growth; for merging up, down, or sideways; or for retirement and succession. Consider the typical small, local firm of two or three partners with maybe seven staffers: Tax prep and bookkeeping provide the core revenue streams. Most aren’t big enough yet to need a firm administrator. The owners make the technology decisions. They have one office. And they’re grossing $1 million to $5 million a year.

Now suppose our “typical” three-partner firm is considering what to do next. Should they:

- Wind down the business as partners retire and clients drift off?

- Bring in a new partner?

- Merge into a larger firm?

- Acquire a smaller firm?

- Accelerate organic growth?

What would that look like? The Accounting Firm Operations and Technology Survey shows us very clearly what each of those scenarios might entail. For instance, the small multi-owner firm needs to know that firms just one class-size larger—the firms with up to 50 people and four to five partners—are more likely to:

- offer a few more specialized services,

- operate a second office,

- have a full-time firm administrator, and

- an IT manager who leads the technology decision-making.

So, for that smaller firm looking to grow, the survey shows how to best prepare for the next step in becoming a “mid-size” firm.

Consider this 10-point list of considerations small firms should undertake as they consider growth:

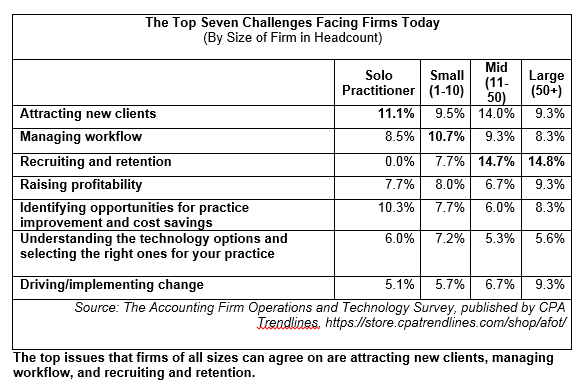

- Workflow – Mid-size firms are more likely than small firms to have already solved their workflow issues and are focusing on attracting new clients and the best talent.

- Management – Partners at mid-size firms are spending less time on client matters and more time managing their practices than smaller firms.

- Service offerings – Most small firms have added all the services they can, limiting their revenue growth. But mid-size firms are continuously building out their offerings to accelerate revenue growth.

- Outlook, Excel, and Word – Small firms are more likely to be subscribed to Office 365, while mid-size firms have purchased the Microsoft desktop package.

- Document management – Small firms that today use FileCabinet CS for their document manage system may need to switch to the favored application at mid-size firms: CCH Document.

- Tax preparation – The leading tax prep app at small firms in the survey is UltraTax CS, but mid-size firms favor CCH Prosystem FX.

- Time and billing – For practice management time-and-billing software, small firms like Thomson’s Practice CS. Mid-size firms prefer CCH Practice Management.

- Payroll – Small firms lean toward QuickBooks for running payrolls. Mid-size firms are more likely to use an outside agency, like ADP or Paychex.

- Internet browser – Small firms like Google Chrome. Mid-size firms go with Internet Explorer.

- M&A – Mid-size firms are twice as likely as small firms to be planning expansion through a merger within the next 12 months.

With Johnston’s and Garrett’s survey in hand, firms of any size can both foresee their futures, as well as gain the tools to make it happen. It’s a roadmap with many roads. Choose wisely.

Rick Telberg is founder and CEO of CPA Trendlines Research, at https://cpatrendlines.com/ and https://store.cpatrendlines.com/, the leading independent source of actionable intelligence for tax, accounting, and finance professionals. The Accounting Firm Operations and Technology Survey cited in the article is available at: https://store.cpatrendlines.com/shop/afot/.