By Ben Hamrick, CPA

Many would say that CPA firm succession is one of the most significant issues facing the profession and has been for some time. In a recent article by Marc Rosenberg, “Baby Boomers Retiring in Droves,” the succession issue was number three on the list of 14 challenges facing the CPA profession. This was followed by number seven on the list: “Firms continue to suck at succession planning.”[1] Rosenberg goes on to say that only 20–30% of first-generation firms make it to the second. Clearly the issue is still with us.

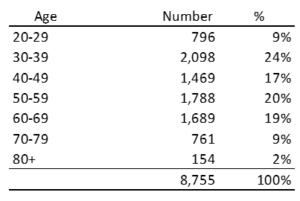

Let’s take a look at the numbers. There are currently 8,755 licensed North Carolina CPAs in public practice according to information provided by North Carolina State Board of CPA Examiners. The table below shows CPAs in public practice by age group.

As you can see from the table, 50% of licensed CPAs in public practice are 50 years and older and 30% are age 60 and older. The numbers alone would suggest there will be a lot of transition in the near future.

Several of us on NCACPA’s Succession Planning Task Force have received calls from firms desperately looking to sell or merge their practice because of an unexpected illness or retirement of a key partner. It seems these calls have increased over the past year.

It can be challenging to think about planning for succession when we are dealing with constantly changing tax laws, technology, federal programs, attracting and retaining talent, cybersecurity, diversity and inclusion, and the list goes on. Of course, most recently, a virus has impacted most everything we do and how we do it.

As CPAs, we impact many people and businesses including our team members and their families, the employees of our clients and their families, and many community organizations that we each support. This makes succession planning very important to more than just the retiring owners. Planning for succession is not just for the 60+ age group, but all age groups. In the best case, succession is baked into each firm’s hiring practices earlier on and throughout an employee’s career. Planning for the new generation of leadership takes time and effort but is well worth the investment. Time and energy invested in planning for succession creates great opportunities for the younger CPAs.

Succession planning is not easy and requires continuous attention as things can change overnight. Many firms have built succession into the fabric of their firms. For others, now is a good time to get started. Your NCACPA Succession Planning Task Force has been working collaboratively with the North Carolina State Board of CPA Examiners on this very topic. There are excellent tools and resources available to assist you.

1 Marc Rosenberg, The 14 Trends Crushing Today’s Accountants, CPA Trendlines.

The NCACPA Succession Planning Resource Team is offering a complimentary 60-minute CPE program entitled Structuring a Successful Succession Plan led by Joel Sinkin, President of Transition Advisors, LLC, on Thursday, November 11, 2021 from 12:00 – 1:00 pm EST. The event is free for all attendees and you are not required to be a member to participate.

Please visit https://staging.ncacpa.org/succession-planning-tools-resources/ for more information on this event and other succession planning resources from NCACPA.