After months of negotiations, federal lawmakers voted along party lines to enact H.R. 5376, the Inflation Reduction Act. The bill...

by Michael R. Gillis, CPA, PFS, CGMS, Managing Partner, DMJ & Co., PLLC As part of providing great service, CPAs...

The AICPA has issued a proposal to update key terminology and certain ethics interpretations to better align with changes made...

The AICPA has issued a proposal to make updates to the Peer Review standards. The changes are primarily formatting to...

By Ben Hamrick, CPA Many would say that CPA firm succession is one of the most significant issues facing the...

This week’s GLS blog addresses the final standards that were issued by the AICPA, FASB and GASB in the third...

The U.S. has seen historic levels of federal funding in response to the COVID-19 pandemic. Various laws, including the CARES...

The AICPA’s Professional Ethics Executive Committee (PEEC) has issued a proposal to revise the rules around unpaid fees. The current...

The AICPA has issued a proposed ethics interpretation to help CPAs understand to what extent they can assist clients with...

FASB has issued a proposed ASU addressing the accounting for investments in equity securities measured at fair value that are...

This week’s blog addresses part 2 of the IFR4NPO Consultation Paper. The second part of the paper focuses on NFP...

The AICPA is in the process of updating the CPA exam and is looking for CPAs to give them feedback...

Reprinted with permission of the Indiana CPA Society The one constant of technology is that it’s always changing. Keeping up with...

The AICPA has provided a Fraud Risk Framework document to help CPAs and their clients visualize the types of fraud...

The AICPA has issued a TQA addressing questions about how for profit and nonprofit entities account for the new restaurant...

Governmental Accounting Standards Board (GASB) issued a REVISED exposure draft regarding Notes to the Financial Statements. This is in preparation...

Have you ever wanted to influence the topics that FASB covers in its standard setting? Well, now here’s your chance....

In case you missed it, NCACPA is partnering with Galasso Learning Solutions to deliver weekly vlogs (video blogs) covering the...

NCACPA is partnering with Galasso Learning Solutions to deliver weekly vlogs (video blogs) covering the latest developments in accounting and...

FASB has issued an exposure draft regarding the use of the discount rate alternative offered to nonpublic entities. After receiving...

GASB has issued an exposure draft, Accounting Changes and Error Corrections an amendment of GASB Statement No. 62, to update...

This week’s podcast focuses on the following items: A quick discussion of what know (little) and don’t know (a lot)...

On March 30th, the FASB issued ASU 2021-03, Accounting Alternative for Evaluating Triggering Events. The ASU provides an accounting alternative...

The first quarter of 2021 is a wrap. It was a light quarter for standard setting and given everything else...

The AICPA has issued a Technical Q&A to address common questions regarding what qualifies as a third party assessment and...

Today marks the one year anniversary of NCACPA transitioning to a fully remote work environment. As we look ahead to...

The AICPA’s Professional Ethics Executive Committee (PEEC) has issued an updated proposal around reporting noncompliance with laws and regulations (NOCLAR)....

The AICPA issued a very narrow proposal to add a new requirement for successor auditors to discuss suspected fraud and...

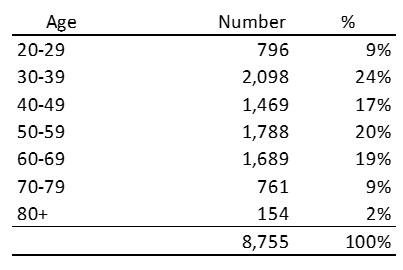

How did 2020 small firm net revenue compare to 2019? How are small firms adjusting their real estate footprint post-COVID?...

Today, March 8, marks International Women’s Day (IWD), where people around the world celebrate the social, financial, cultural, and political...

The final video blog in our QM series addresses the proposed audit standard. The audit standard assists the engagement team...

On Monday, February 22, NCACPA’s Connect platform underwent a scheduled update. As a result of this maintenance, we want to...

This week’s video blog continues with the discussion of the AICPA’s proposed changes to Quality Management. SQMS 2 addresses the...

Meet Michael Charles Pridgeon, a Certified Public Accountant (CPA) that is the visionary of Break the Cycle, a program that...

The AICPA issued three new proposals related to quality management. The new SQM Standards will replace the extant quality control...

The AICPA’s Professional Ethics Executive Committee (PEEC) has issued a Temporary Policy Statement regarding the recent changes by the SEC...

The World Economic Forum has released its 2020 Future of Jobs Report which looks at the impact of technology on...

In July 2019, North Carolina passed House Bill 924 which mandates an economics and personal finance (EPF) course. Beginning with...

By Sandra Finerghty, Supporting Strategies Small business owners can get the benefit of high-level financial guidance without making a full-time...

In 2019, the AICPA issued a consultation paper for feedback on the projects PEEC should address. After evaluating feedback, PEEC...

Click READ THE ARTICLE below to view the full blog post!

Goodwill Impairment Proposal FASB has issued a proposal to adjust the timing for when private entities and nonprofits would be...

DID YOU KNOW? MLK Day is the only federal holiday designated as a national day of service. Join us in...

By Rick Meyer, CPA, MBA, MST As we start the New Year, hopefully fresh from all the tax drama,...

By Chris Word, CPA In the wake of the recent social unrest, it is easy to assume the answer to...

Click READ THE ARTICLE below to view the full blog post!

Click READ THE ARTICLE below to view the full blog post!

By Sandra Finerghty, Supporting Strategies What is the future of remote work? Many businesses weren’t ready when COVID-19 forced them...

Click READ THE ARTICLE below to view the full news post!

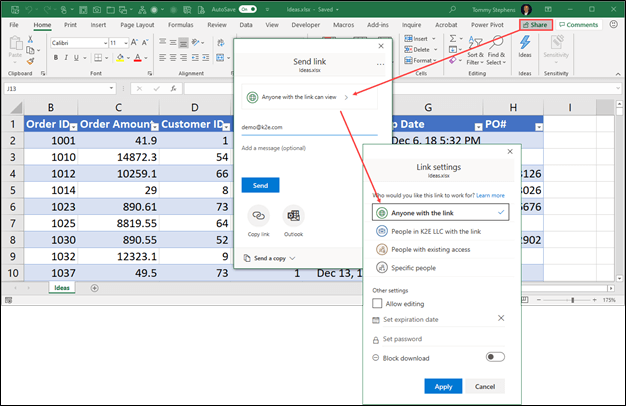

Thomas G. Stephens, Jr., CPA, CITP, CGMA Collaboration is more important today than it ever has been. With many team...

Michael F. De Stefano, CPA Recently I had a conversation with a coworker about professional development to help them prepare...

There’s always an element of uncertainty in starting a new business. You’re always wondering if the risk element is too...

By Benjamin Aspir, CPA, MST, EisnerAmper Today’s CPAs can pursue many different career paths. While many CPAs work in business...

By Randy Johnston and Sam Saab Higher client expectations and economic demands are causing firms of all sizes to re-evaluate...

Click READ THE ARTICLE below to view the full blog post!

By Thomas G. Stephens, Jr., CPA, CITP, CGMA For many, the Holiday Season is a time to look back...

2020 tax season has been the most intimidating one in many years. It taught us lessons that we should now...

2021 Retirement Plan Limits The IRS released Notice 2020-79 [PDF] to provide for cost-of-living adjustments to dollar limitations for retirement...

The process of setting up an environment of motivation in an organization, where employees and managers are reviewing themselves regularly,...

By Jackie Ferguson The election is finally over and we have a new president….or the same president. Maybe it’s still...

By Jessica L. Levin, Seven Degrees LLC The CPA Exam. What used to be a fundamental part of working in...

By the Student Outreach, Advancement, and Recruitment (SOAR) Committee The world as we know it has changed. The impacts of...

By Erik Asgeirsson, President and CEO of CPA.com This past year has further emphasized the importance of thinking strategically about...

By Eileen Monesson, CPC, PRCounts By the time the coronavirus pandemic hit, we were full swing into networking season. Most...

Tax season is when millions of people and organizations turn to the expertise of professionals such as tax preparers, tax...

The Daily Details was founded by Nicole and Kiri, two sisters who worked as CPAs in Uptown, Charlotte. They dreamt...

Women’s Equality Day, celebrated annually on August 26, marks the anniversary of the ratification of the 19th Amendment which granted...

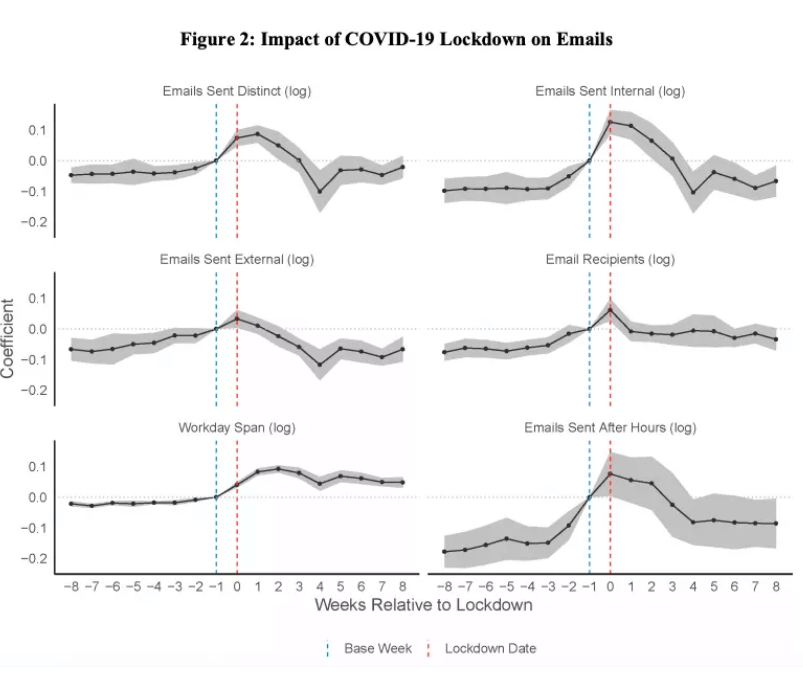

By Andy Dunn, Writer, Formative Content Employees based at home during COVID-19 lockdowns have seen the length of their working days...

By David Tepp, CPA, PFS, MBA, Tepp Financial Planning One surefire way to initiate an awkward discussion with a client...

The home office deduction allows qualifying taxpayers to deduct certain home expenses on their tax return. With more people working...

Amid the threat of COVID-19, CPAs could be facing another health crisis: a mental one. By Bridget McCrea By now,...

For most homeowners, their mortgage is their biggest monthly expense. But job losses around the country are hammering people’s finances,...

By Carly Rutledge Due to social distancing requirements, this year’s “Meet the Chair” interview was a bit unconventional. With...

Money is one of the biggest stressors in many American’s lives. A 2017 AICPA survey found that 56% of Americans...

By Ken Tysiac The racial injustice taking place throughout the United States has hit home hard for members of the...

Following NCACPA’s Annual Business Meeting and Focus on the Profession session, we were delighted by the influx of positive input...

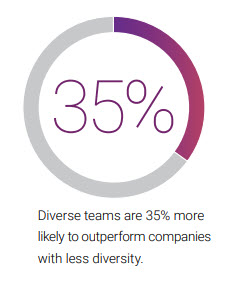

Efforts to improve diversity and inclusion really do make a difference. McKinsey found that companies in the top quartile for...

By Benjamin Aspir, CPA, MST, EisnerAmper Today’s CPAs can pursue many different career paths. While many CPAs work in...

By Laura Morgan Roberts and Ella F. Washington The United States is in crisis. As we write this article, videos of racial...

By Donald J. Kaiser, CPA, McCarthy & Company, PC Internal controls are among the most important anti-fraud controls that...

By Brad Smith Image from pixabay.com Accountants have access to very sensitive data, which includes information such as credit card...

This week’s podcast focuses on the following items: IRS changes its guidance on the payment of health insurance only and...

This week’s podcast focuses on the following items: PPP loan updates on corporate groups, businesses sold after February 15, 2020,...

A native of Eden, NC, Elwood Walker earned his undergraduate degree from UNC-Chapel Hill and master’s degree from Duke University....

By Will Douglas Heaven Far from breaking it, the surge in usage the internet is seeing right now is driving...

This week’s podcast focuses on the following items: PPP Loan program and EIDL Grants Get Additional Funding PPP guidance raises...

This week’s podcast focuses on the following items: SBA issues guidance on self-employed taxpayers and partners for PPP loan program...

By Sandra Finerghty, Supporting Strategies It’s not surprising that many new business owners devote little thought to their exit strategy....

This week’s podcast focuses on the following items: Recovery Rebate for Individuals, Including Advance Payment Deferral of the Required Minimum...

By Bryony Clear Hill COVID-19 is presenting the world with an unprecedented crisis. Millions of people are concerned for their...

This week’s podcast focuses on the following items: Payroll tax credit starts on April 1. IRS reverses courses, announces gift/GSTT...

By Carly Rutledge While many of you find it challenging to balance the workload and challenges resulting from the Coronavirus...

Maintaining a social media account can feel like a second job to some, while others utilize it as a break...

This week’s podcast focuses on the following items: Congress passes payroll tax credit for newly mandated paid sick leave Initial...

By Ed Carter Even if your disability allows you to live on your own and care for yourself in your...

By Paul Weeks Artificial Intelligence (AI), machine learning, deep learning, data analytics — all are hallmarks of any discussion surrounding...

This week’s podcast focuses on the following items: President declares emergency over COVID-19, directs Treasury to provide relief–and now we...

By James Clear Agnes de Mille had just achieved the greatest success of her career, but right now the only...

In light of the current COVID-19 (Coronavirus) situation, many employers are recommending or mandating employees who are able to work...

Most parents take certain steps to protect their children in the event of their premature death. Drafting a will or...

By Jessica Curtin Planning for a secure retirement is a top-of-mind priority for almost every American worker. Yet, according to a...

By Jared Korver, CPA, at Beacon Wealthcare Networking has become a four-letter word with ten letters, and look, I have...

Becoming a student member of your state society is an excellent idea, and there are a whole lot of reasons to join...

This week’s podcast focuses on the following items: IRS denies a taxpayer’s request to make a late mark to market...

By Stephanie Vozza Looking for a new job is stressful enough, but to make matters more challenging, some interview questions...

CPA state society membership is not just for practicing CPAs. In fact, many offer a range of services and programs...

This week’s podcast focuses on the following items: Taxpayer who voluntarily exited OVDI program ended up with very poor result....

Part 10 of 10 In honor of Black History Month, NCACPA would like to celebrate the diverse individuals who contributed to...

Part 9 of 10 In honor of Black History Month, NCACPA would like to celebrate the diverse individuals who contributed to...

Part 8 of 10 In honor of Black History Month, NCACPA would like to celebrate the diverse individuals who contributed to...

Part 7 of 10 In honor of Black History Month, NCACPA would like to celebrate the diverse individuals who contributed to...

Part 6 of 10 In honor of Black History Month, NCACPA would like to celebrate the diverse individuals who contributed to...

This week’s podcast focuses on the following items: Proposed regulations can be relied upon in the interim, as well as...

Part 5 of 10 In honor of Black History Month, NCACPA would like to celebrate the diverse individuals who contributed to...

Part 4 of 10 In honor of Black History Month, NCACPA would like to celebrate the diverse individuals who contributed to...

Part 3 of 10 In honor of Black History Month, NCACPA would like to celebrate the diverse individuals who contributed to...

Part 2 of 10 In honor of Black History Month, NCACPA would like to celebrate the diverse individuals who contributed to...

The Triad Women’s Initiative Networking Group strives to facilitate connections between Triad-area women while encouraging social, personal, and professional...

By Ranica Arrowsmith This year’s top products were selected for their contact with innovation, whether it’s in actual technology—injecting artificial intelligence,...

By Tom Miller More than 1.9 billion records containing personal and other sensitive data were compromised between January 2017 and...

This week’s podcast focuses on the following items: Regulations implementing changes to FAVR and cents-per-mile methods finalized by IRS OIRA...

By Sandra Finerghty, Supporting Strategies Even the most competent, upstanding, conscientious business owners tend to fret over filing their taxes....

Happy 2020 Everyone! I wanted to provide an update regarding our work to date on NCACPA’s Succession Planning Task Force....

This week’s podcast focuses on the following items: Special agent in charge of Los Angeles CID talks about their potential...

This week’s podcast focuses on the following items: IRS can use sample of transactions to carry burden for §165(c) kickbacks/bribery...

This week’s podcast focuses on the following items: IRS expands rules excluding from income discharge of certain student loan debt...

Each year, Accounting Today recognizes the 100 Best Firms to Work For in the U.S. — and then picks the 10 Best...

The Financial Accounting Foundation announced the availability of the 2020 GAAP Financial Reporting Taxonomy, the 2020 SEC Reporting Taxonomy, and...

By Brooks Aker, CPA The Young CPA Cabinet (“YCPA Cabinet” or “cabinet”) enjoyed terrific accommodations at East Carolina University (ECU)...

This week’s podcast focuses on the following items: Further Consolidated Appropriations Act, 2020 signed into law on December 20, 2019...

By Ben Hamrick, CPA After the (literal) blood, sweat, and tears owners put into a firm, it can be hard...

By Stacee Rash, CPA Retiring partners are not the only CPAs with succession planning on their minds these days. Young...

This week’s podcast focuses on the following items: IRS does not have the discretion to waive repayment of advance premium...

Business owners are finding themselves having to constantly adapt to an ever-changing market, due to the speed at which new...

This week’s podcast focuses on the following items: Final version of 2020 Form W-4 released Final versions of 2019 Forms...

Ah the holidays. The time when you remember that malls exist and are thankful for online shopping. Maybe most people...

By Terrence Putney, CPA and Joel Sinkin The end of your professional career is something you will eventually face. How...

This week’s podcast focuses on the following items: Commissioner rules that insurance payments for pyrrhotite damage does not require Forms...

This week’s podcast focuses on the following items: IRS discusses information security responsibilities and risks for tax professionals Rental section...

This week’s podcast focuses on the following items: Significant TCJA guidance to be issued by end of January 2020 PLR...

This week’s podcast focuses on the following items: Federal Circuit shoots down previously successful taxpayer argument that limited maximum FBAR...

By Alessandra Malito Millions of workers contribute to a 401(k) plan so they can have more money when they retire...

By Lydia Dishman Diversity and inclusion are more than just buzzwords or boxes to check. Millennials believe they are essential...

This week’s podcast focuses on the following items: Wisconsin fails in attempt to look to sublease to tax software sales...

By Jennifer Kim Nobody’s ever said that diversity and inclusion work is easy. But having grown a team that became known for...

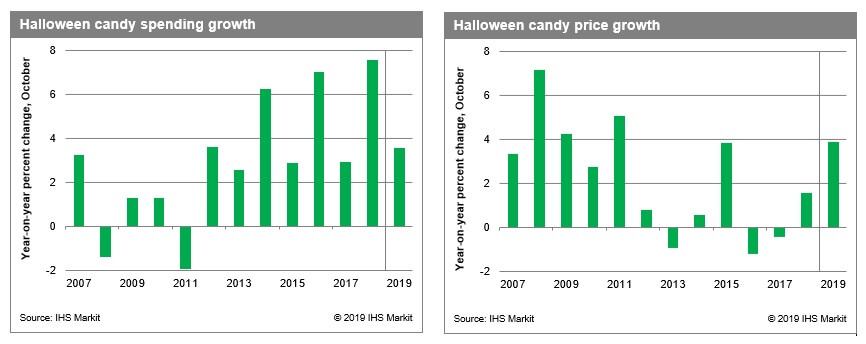

By David Deull, Principal Economist, IHS Markit IHS Markit is forecasting 2019 Halloween candy prices to rise 3.9% over last...

By Justin Bariso A few years ago, Google went on a quest to build the perfect team. The goal was to figure...

By Randy Johnston, Executive Vice President, K2 Enterprises Are you doing things the same old way? Do you wish there...

This week’s podcast focuses on the following items: California rules on tax issues for directors that have meeting in California...

With Election Day 2020 only one year away, it is the ideal time to remind our members of the importance...

$20.20 doesn’t seem like much money. It can get you four lattes from Starbucks, lunch for you and a coworker,...

At NCACPA, we often say that advocacy is a member benefit North Carolina CPAs won’t receive anywhere else, and it’s...

While fraud can damage any organization, it can devastate small businesses, which often lack the resources for proper anti-fraud controls....

Tax Reform Don’t forget to check the IRS.gov Tax Reform pages regularly for the latest information. Changes to Transcript Delivery...

By Susan S. Coffey, CPA, CGMA, EVP — Public Practice, Association of International Certified Professional Accountants Back in January, I wrote...

Hello Friends, We had a great group of ladies at the May luncheon. Elizabeth Keller of CliftonLarsonAllen took us through...

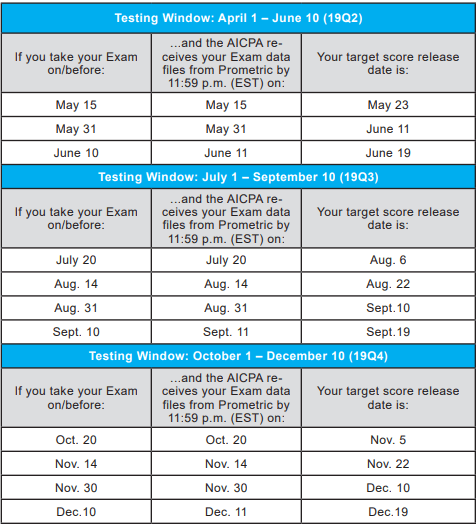

A few things to note about CPA Exam score dates: All dates and times are based on Eastern Time zone....

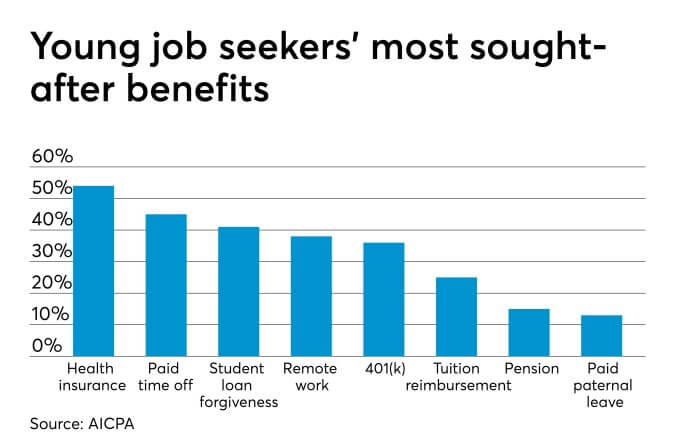

By Sean McCabe As graduation season approaches for college students across the country, student loan forgiveness is on a lot...

By Michael Cohn The Internal Revenue Service’s audit rate went down again in 2018, according to data released Monday by...

The accounting services industry is projected to grow at 1.8% overall between 2012 and 2017. That growth is triggering international...

By Lee Barney MassMutual says a married couple that lives into their 90s but decides to begin their Social Security...

The General Assembly recessed its 2022 short session on July 1. Although the short session featured no major tax legislation,...

State lawmakers are hopeful that they can reach an agreement on budget adjustments by June 17. The House and Senate...